Mortgage Closing Costs Explained: What You Pay and Why

You’ve saved for the down payment, found your dream home, and secured a great interest rate. Then, a few days before the deal is finalized, you receive the Closing Disclosure. The total due at signing is thousands more than you anticipated. This moment of sticker shock is a common, and often stressful, rite of passage for homebuyers. Understanding mortgage closing costs before you reach the settlement table is not just about budgeting, it’s about empowerment and avoiding last-minute financial surprises that could derail your purchase.

Visit Estimate Your Closing Costs to get your personalized loan estimate and avoid closing cost surprises.

What Are Mortgage Closing Costs?

Mortgage closing costs are the fees and expenses you pay to finalize your home loan and transfer property ownership. They are separate from your down payment and are due at the closing, or settlement, of your real estate transaction. Think of them as the administrative and service charges required to make the mortgage and sale legally binding and properly recorded. These costs cover the work of numerous parties involved in the process, including lenders, title companies, appraisers, and government agencies. While they can feel like a barrage of line items, each serves a specific purpose in protecting the interests of the buyer, seller, and lender.

The total amount varies widely but typically ranges from 2% to 5% of the home’s purchase price. For a $400,000 home, that means you should budget between $8,000 and $20,000 for closing costs, in addition to your down payment. Some costs are fixed, while others are variable. Some can be shopped for, and others are non-negotiable. Breaking them down into categories is the first step to demystifying them.

A Detailed Breakdown of Common Closing Costs

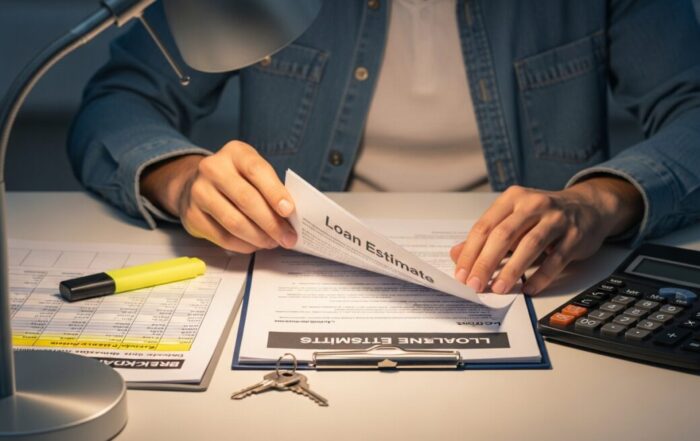

Closing costs are itemized on your Loan Estimate (provided within three days of application) and your Closing Disclosure (provided three days before closing). Here is a comprehensive look at the most common fees you will encounter.

Lender-Related Fees

These are charges from your mortgage company for processing, underwriting, and funding your loan. The origination fee is a core charge, often 0.5% to 1% of the loan amount, covering the lender’s administrative costs. The underwriting fee pays for the cost of evaluating your loan application and risk. You may also see an application fee or a processing fee. Some lenders offer “no-closing-cost” mortgages, but these typically involve a higher interest rate or the costs being rolled into the loan principal.

Third-Party and Required Services

These are fees for services the lender requires but are often performed by independent companies. The appraisal fee ($300 to $600) pays for a professional assessment of the home’s market value. The credit report fee covers the cost of pulling your credit history. Title services include two key components: title search and title insurance. The search ensures the seller legally owns the property and there are no undisclosed liens. Title insurance protects the lender (and optionally, you, the buyer) from future claims against the property’s ownership.

Prepaid Expenses and Escrow

These are not fees, but payments you make in advance. They include homeowners insurance premiums (often one year upfront), prepaid interest (interest that accrues from your closing date to the end of that month), and initial deposits into your escrow account. Lenders typically require you to fund an escrow account with several months’ worth of property taxes and insurance premiums to ensure these bills are paid when due.

Government and Recording Fees

These are charges from state and local governments to legally record your deed and mortgage. Recording fees are paid to the county clerk to make the sale part of the public record. Some localities charge transfer taxes, a tax on the transfer of property from seller to buyer. Who pays this (buyer or seller) is often determined by local custom or negotiation.

To provide a clearer picture, here is a list of typical closing cost line items you might see on your disclosure, grouped by payer responsibility where common.

- Buyer-Paid (Typically): Loan origination fee, appraisal fee, credit report fee, homeowner’s insurance (first year), prepaid interest, escrow account funding, recording fees for the deed.

- Seller-Paid (Often): Real estate agent commissions, transfer taxes (varies by location), recording fees for releasing the old mortgage.

- Negotiable: Title insurance (owner’s policy), home warranty, certain inspections, and sometimes even the split of transfer taxes.

Remember, everything in a real estate contract is negotiable. While some fees are fixed, who pays for certain items can be part of your offer strategy, a point we will explore later.

How to Estimate Your Closing Costs Accurately

Accurate estimation begins with two key documents mandated by law: the Loan Estimate and the Closing Disclosure. Within three business days of your mortgage application, your lender must provide a Loan Estimate. This three-page form provides a good-faith estimate of your loan terms, projected monthly payments, and closing costs. Use this to compare offers from different lenders. The costs on page 2, in Section B, are services you can shop for (like title services), while others are services you cannot.

Visit Estimate Your Closing Costs to get your personalized loan estimate and avoid closing cost surprises.

At least three business days before closing, you will receive the Closing Disclosure. This is the final, detailed accounting of your transaction. Compare it line-by-line with your Loan Estimate. By law, certain costs cannot increase significantly from the estimate (typically a 10% tolerance for some fees), while others can change. This review period is your last chance to ask questions and clarify any discrepancies.

Beyond these documents, proactive steps include using online closing cost calculators (available on many bank and real estate sites) and simply asking your lender and real estate agent for a detailed worksheet early in the process. A seasoned agent should be able to provide a fairly accurate estimate based on the purchase price and location.

Strategies to Reduce Your Closing Cost Burden

While you cannot eliminate closing costs entirely, you can employ several strategies to manage and reduce their impact on your cash reserves.

First, shop around for your lender. Lender fees can vary by thousands of dollars. Get Loan Estimates from at least three different lenders (banks, credit unions, online lenders) and compare not just the interest rate, but the total closing costs in Section J. Second, negotiate with the seller. In a buyer’s market or during negotiations, you can ask the seller to contribute to your closing costs via a “seller concession.” There are limits to how much a seller can contribute based on your down payment and loan type, but it can significantly reduce your out-of-pocket expense.

Third, negotiate fees directly. Ask your lender if any fees (like the application or processing fee) can be reduced or waived. You can also shop for services like title insurance and pest inspections, as the lender must allow you to choose your own provider for these “shop-for” services. Finally, explore closing cost assistance programs. Many state and local governments, as well as non-profits, offer grants or low-interest loans to help first-time or low-to-moderate income buyers with closing costs. Your lender or a HUD-approved housing counselor can help you find these programs.

The Role of Discount Points

One unique component of closing costs is the option to purchase mortgage discount points. One point costs 1% of your loan amount and typically lowers your interest rate by 0.25%. This is a classic trade-off: pay more upfront in closing costs to secure a lower monthly payment for the life of the loan. Whether this makes financial sense depends on how long you plan to own the home. You need to calculate the “break-even point,” the time it takes for the monthly savings to exceed the upfront cost of the points. If you plan to stay in the home longer than that break-even period (often 5-8 years), buying points can be a wise investment.

Frequently Asked Questions

Can closing costs be rolled into the loan? Generally, no, for most conventional loans. Closing costs must be paid in cash at settlement. However, some government loans (like VA loans) allow certain costs to be rolled in, and “no-closing-cost” mortgages essentially roll the fees into a higher loan balance or interest rate.

Who pays closing costs, the buyer or the seller? Both parties pay different sets of closing costs. The buyer typically pays the majority of fees associated with the new mortgage. The seller typically pays the real estate agent commissions and their share of transfer taxes. The split of other costs is often a point of negotiation.

Are closing costs tax deductible? In most cases, no, for the tax year of the purchase. The only closing costs that are deductible on your annual income taxes are mortgage interest (the prepaid interest at closing) and real estate taxes (paid into escrow). However, points purchased to lower your interest rate are usually deductible, but specific rules apply. Always consult a tax advisor.

What happens if I don’t have enough cash for closing? A shortage of funds at closing will delay or cancel the transaction. It’s critical to budget for closing costs from the start. If you discover a shortfall, immediately discuss options with your lender and agent, such as re-negotiating with the seller for concessions or exploring a gift from a family member (with proper documentation).

Is a “no-closing-cost” mortgage a good idea? It can be a helpful tool if you are short on cash and plan to sell or refinance within a few years. However, because you pay a higher interest rate, it will cost you more over the long term. It’s essential to run the numbers for your specific timeframe.

Mastering the details of mortgage closing costs transforms you from a passive participant to an informed buyer in control of your financial transaction. By understanding the fees, estimating accurately, and employing smart reduction strategies, you can approach the closing table with confidence, not anxiety. This knowledge ensures your home purchase begins on solid financial ground, allowing you to focus on the excitement of owning your new home.

Visit Estimate Your Closing Costs to get your personalized loan estimate and avoid closing cost surprises.