How to Shop for Mortgage Rates and Save Thousands

When you decide to buy a home or refinance your existing loan, the single most important financial action you can take is shopping mortgage rates. This process, which involves comparing loan offers from multiple lenders, is not just a formality. It is the proven, concrete strategy that can save you tens of thousands of dollars over the life of your loan. Yet, many borrowers, overwhelmed by the homebuying process or assuming all lenders offer similar terms, skip this vital step. They accept the first offer they receive, leaving a staggering amount of money on the table. In today’s market, where even a fraction of a percentage point translates to significant long-term savings, being an informed and active rate shopper is non-negotiable. This guide will walk you through the entire process, from understanding what a mortgage rate truly includes to executing a strategic comparison that secures you the best possible deal.

Visit Compare Rates Now to compare your personalized loan estimates and secure your best rate today.

What You Are Really Comparing When You Shop Rates

At its core, shopping for a mortgage rate is about comparing the annual percentage rate, or APR. While the advertised interest rate gets most of the attention, the APR is the more comprehensive figure. It includes not only the interest rate but also most of the other fees you will pay to get the loan, such as origination charges, discount points, and mortgage insurance. This makes the APR a more accurate tool for comparing offers from different lenders. A lender might advertise a tantalizingly low interest rate but then stack on high fees, resulting in a higher APR. Conversely, a slightly higher interest rate with minimal fees could yield a lower APR and be the better financial choice. To make an informed decision, you must look beyond the headline rate and focus on the APR, along with the detailed loan estimate each lender provides.

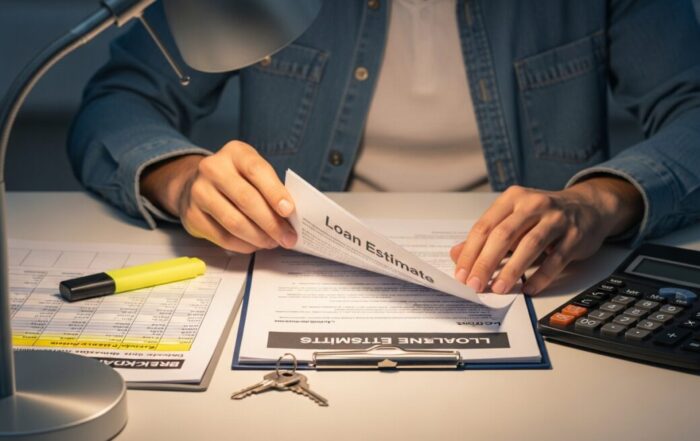

This is where the Loan Estimate form becomes your most powerful tool. By law, within three business days of your loan application, a lender must provide you with this standardized, three-page document. It spells out the estimated interest rate, monthly payment, total closing costs, and, crucially, the APR. Because every lender uses the same format, you can directly compare the numbers on Page 1, Section A (Origination Charges) and Page 3, Section J (Calculations, including Total Interest Percentage). This levels the playing field and allows for an apples-to-apples comparison. When you are actively shopping mortgage rates, you should aim to collect 3-5 Loan Estimates from different types of lenders within a focused 10-14 day period to minimize the impact on your credit score. For a deeper dive into current market conditions and how they influence these numbers, our resource on mortgage rates today provides ongoing analysis.

A Strategic Framework for Mortgage Rate Shopping

Effective rate shopping is a disciplined process, not a haphazard collection of quotes. Following a structured approach ensures you gather complete, comparable information and negotiate from a position of strength. The first step is to know your financial profile. Before you contact a single lender, check your credit report for errors, understand your debt-to-income ratio, and have documentation ready for your income and assets. A strong, verified financial profile is the foundation for receiving the best rates a lender offers. Next, identify the lenders you will approach. Cast a wide net across different institution types: large national banks, local community banks, credit unions, and online mortgage lenders. Each has different business models and overhead, which can lead to significant variation in rates and fees.

Once you have your list, it is time to make contact and request quotes. Be specific and consistent with every lender. Provide the same information about the property type, purchase price, down payment amount, loan type (e.g., 30-year fixed, 15-year fixed), and your desired lock-in period. This consistency is key to generating comparable Loan Estimates. When you receive these documents, do not just glance at the monthly payment. Conduct a thorough, line-by-line comparison. Pay special attention to lender fees (origination, underwriting, processing), third-party fees (appraisal, title insurance), and prepaid items (taxes, insurance). Look for discrepancies and ask lenders to explain or justify any fees that seem unusually high.

To systematize your comparison, follow these core steps:

- Prepare Your Financials: Gather pay stubs, W-2s, bank statements, and check your credit score. Correct any errors on your credit reports.

- Choose Diverse Lenders: Select at least three lenders from different categories (bank, credit union, online lender).

- Apply Consistently: Submit a formal application with the same loan parameters to each lender within a short timeframe to get official Loan Estimates.

- Compare Loan Estimates: Focus on Page 1 (loan terms, projected payments), Page 2 (closing cost details), and Page 3 (APR and cost comparisons).

- Negotiate and Decide: Use the best offer as leverage with other lenders. Choose the loan with the best combination of low APR, acceptable fees, and a lender you trust.

Key Factors That Influence Your Mortgage Rate

Understanding what goes into determining your specific mortgage rate empowers you to improve your position before you start shopping. While market forces like the 10-year Treasury yield and Federal Reserve policy set the broad baseline, your personal financial situation determines your final, personalized rate. Lenders assess risk, and the less risky you appear, the lower the rate they will offer. Your credit score is the single most important personal factor. Generally, a score above 740 will qualify you for the best available rates, while scores below 680 will lead to higher rates or require additional scrutiny. The size of your down payment also signals risk. A larger down payment, typically 20% or more, not only avoids private mortgage insurance (PMI) but also demonstrates equity and financial stability, often resulting in a slightly better rate.

Visit Compare Rates Now to compare your personalized loan estimates and secure your best rate today.

The loan-to-value ratio (LTV), which is the loan amount divided by the home’s value, is directly tied to your down payment. A lower LTV (meaning more equity) is less risky for the lender. Your debt-to-income ratio (DTI) is another critical metric. This measures your total monthly debt payments (including the prospective mortgage) against your gross monthly income. Most conventional loans prefer a DTI below 43%, with lower ratios being more favorable. Finally, the loan type and term matter. Government-backed loans like FHA or VA often have different rate structures than conventional loans. Adjustable-rate mortgages (ARMs) typically start with a lower rate than fixed-rate mortgages but carry future uncertainty. For specialized loan amounts, understanding the nuances is essential. If you are considering a loan above the conforming limit, our analysis of understanding jumbo mortgage rates explains the distinct qualifying criteria and pricing.

Common Pitfalls to Avoid When Comparing Rates

Even motivated shoppers can make costly mistakes if they are not careful. One of the most common errors is focusing solely on the advertised interest rate without considering the associated fees and APR. A low rate with high points and fees can be more expensive than a slightly higher rate with minimal costs. Another pitfall is not getting all quotes within the same short window. Mortgage rates can change daily, and sometimes intraday. If you get one quote on Monday and another on Friday, you might be comparing market movements rather than lender competitiveness. Furthermore, failing to get a formal Loan Estimate and relying on vague verbal quotes or pre-qualification letters leaves you without the legally binding, detailed breakdown needed for true comparison.

Shoppers also sometimes neglect to consider the lender’s reputation and service quality. The cheapest loan from a lender with terrible communication, frequent delays, or a history of closing problems is not a good deal. Read reviews, ask for referrals, and assess responsiveness during the quote process. Finally, many borrowers forget they can negotiate. Mortgage lending is competitive. If you have a Loan Estimate from Lender A with a great APR, you can present it to Lender B and ask if they can beat it. Often, they can or will adjust fees to become more competitive. You are not obligated to accept the first offer, and a polite negotiation can yield a better final deal.

Frequently Asked Questions on Mortgage Rate Shopping

Does shopping for mortgage rates hurt my credit score?

When done correctly, no. Credit scoring models recognize that consumers may shop for the best loan terms for a major purchase like a mortgage. If you submit all your applications within a focused shopping period (typically 14-45 days, depending on the scoring model), multiple credit checks from mortgage lenders are usually counted as a single inquiry, minimizing the impact on your score.

How much can I really save by shopping around?

The savings are substantial. According to data from the Consumer Financial Protection Bureau (CFPB), borrowers can save an average of $1,500 over the life of the loan by getting one additional rate quote, and $3,000 by getting five quotes. On a 30-year loan, a difference of just 0.25% in your interest rate can save or cost you tens of thousands of dollars.

Should I pay discount points to buy down my rate?

Paying points (an upfront fee equal to 1% of your loan amount) to lower your interest rate can be a good strategy if you plan to stay in the home for a long time, typically more than 5-7 years. It is a trade-off: higher upfront cost for a lower monthly payment. You need to calculate the “break-even” point to see if the monthly savings will eventually exceed the upfront cost. This calculation is especially important for first-time buyers to understand, as detailed in our guide for first time home buyer mortgage rates.

When is the best time to lock my interest rate?

You should lock your rate when you are comfortable with the offered rate and closing costs, and when you have a clear closing timeline (usually after your purchase contract is ratified and the appraisal is ordered). A rate lock is a guarantee from the lender that your rate will not change for a specified period, usually 30 to 60 days. Consider the lock period’s length and whether the lock includes fees or a float-down option, which allows you to secure a lower rate if market rates fall before closing.

Shopping for a mortgage rate is one of the highest-value financial tasks you will ever undertake. The hours you invest in gathering Loan Estimates, comparing fees, and negotiating with lenders have a direct, measurable return that compounds over decades. By approaching the process with a clear strategy, an understanding of the key factors at play, and a willingness to do the detailed comparison work, you move from being a passive recipient of terms to an active manager of your largest financial commitment. The goal is not just to find a loan, but to secure the right loan on the best possible terms, building a stronger financial foundation from the moment you close.

Visit Compare Rates Now to compare your personalized loan estimates and secure your best rate today.