First Time Home Buyer Mortgage Rates Explained for 2026

Navigating the world of first time buyer mortgage rates can feel like deciphering a foreign language. You know it’s the key to unlocking your new home, but the numbers, terms, and qualifications can be overwhelming. Unlike standard rates you might see advertised, the rate you qualify for as a first-time buyer is deeply personal, shaped by your financial history, loan choice, and market timing. This guide cuts through the complexity to explain not just what current rates are, but how they are determined specifically for you, and the actionable steps you can take to secure the most favorable terms on your path to homeownership.

Take control of your homebuying journey. Visit Check Your Rate to get personalized rate insights and connect with a mortgage expert.

How First Time Buyer Mortgage Rates Are Determined

While the national average mortgage rate provides a broad market snapshot, your individual rate is calculated using a more intimate formula. Lenders assess risk, and for a first-time buyer with a shorter credit history or a smaller down payment, that perceived risk can influence the final offer. The primary factors include your credit score, debt-to-income ratio (DTI), down payment size, and the loan type. A higher credit score signals reliability and typically earns a lower rate. Your DTI, which compares your monthly debt payments to your gross income, must usually fall below a specific threshold, often 43%, to qualify for the best terms. The down payment is also critical: putting down less than 20% often requires Private Mortgage Insurance (PMI), which adds to your monthly cost but doesn’t directly lower your interest rate. Conversely, a larger down payment reduces the lender’s risk and can secure a better rate.

Current Loan Types and Rate Comparisons

First-time buyers have several loan program options, each with its own rate structure and qualifying criteria. Conventional loans, which are not backed by the government, often require stronger credit and a higher down payment but can offer competitive rates, especially if you can avoid PMI. FHA loans are popular for their lower minimum credit score and down payment requirements (as low as 3.5%), but they come with both upfront and annual mortgage insurance premiums, which affect the overall cost of the loan. For a deeper dive into this specific program, our detailed guide on understanding FHA mortgage rates breaks down the long-term financial implications. VA loans, for eligible veterans and service members, and USDA loans, for homes in designated rural areas, can offer rates with no down payment and no mortgage insurance, representing potentially the lowest overall borrowing cost for those who qualify.

Fixed-Rate vs. Adjustable-Rate Mortgages

The choice between a fixed-rate mortgage (FRM) and an adjustable-rate mortgage (ARM) is fundamental. An FRM locks in your interest rate for the entire loan term, commonly 30 or 15 years, providing predictable monthly payments. This stability is highly valuable for first-time buyers budgeting for the long term. An ARM typically starts with a lower introductory rate for a set period, such as 5, 7, or 10 years, after which it adjusts annually based on a market index. While the initial lower payment can make homeownership immediately more accessible, it introduces future uncertainty. For buyers confident they will sell or refinance before the adjustment period ends, an ARM can be a strategic tool. Monitoring broader mortgage rate trends and your options is essential when considering an ARM, as your future payments will be tied to those market movements.

Strategies to Secure a Better Mortgage Rate

Securing a favorable rate is not a passive process; it requires proactive financial management and strategic timing. Your actions in the months leading up to your mortgage application are as important as your choices during it. The goal is to present yourself as the least risky borrower possible to potential lenders.

Key steps to improve your rate eligibility include:

- Boost Your Credit Score: Obtain copies of your credit reports, dispute any errors, pay down revolving debt (especially credit cards), and ensure all bills are paid on time. Even a 20-point increase can make a significant difference.

- Save for a Larger Down Payment: Every extra percentage point you can put down reduces the loan-to-value ratio, which can qualify you for a lower rate and potentially eliminate mortgage insurance.

- Lower Your Debt-to-Income Ratio: Pay off smaller debts, avoid taking on new credit (like car loans), and consider ways to increase your stable income before applying.

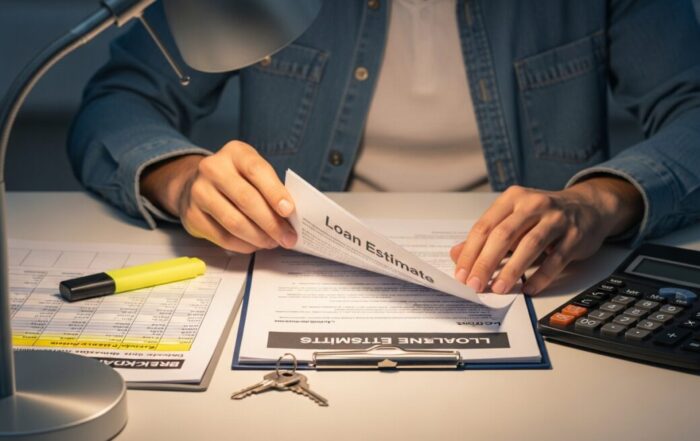

- Shop Multiple Lenders: Rates and fees can vary significantly. Get formal loan estimates from at least three different types of lenders: banks, credit unions, and online mortgage companies.

- Consider Buying Mortgage Points: Points are fees you pay upfront to lower your interest rate. If you have the cash and plan to stay in the home long enough to break even, this can be a wise investment.

Furthermore, the timing of your rate lock is a critical final step. Once you have an accepted purchase offer, you can lock your rate, which guarantees that rate for a specified period, usually 30 to 60 days. This protects you if market rates rise before closing. Understanding these daily fluctuations is why resources that explain jumbo mortgage rates and market dynamics are valuable, as the same economic forces affect all loan tiers.

Take control of your homebuying journey. Visit Check Your Rate to get personalized rate insights and connect with a mortgage expert.

Understanding the Full Cost: Beyond the Interest Rate

Focusing solely on the interest rate is a common first-time buyer mistake. The Annual Percentage Rate (APR) provides a more complete picture, as it includes the interest rate plus most lender fees and closing costs, expressed as a yearly percentage. Always compare APRs when evaluating loan offers. Your monthly payment will also include other non-negotiable costs: property taxes, homeowners insurance, and, if applicable, mortgage insurance (PMI, MIP, or funding fees). Property taxes and insurance are often paid into an escrow account managed by the lender. When budgeting, use your full PITI payment (Principal, Interest, Taxes, and Insurance) as your baseline monthly housing cost, not just the principal and interest amount. This comprehensive view prevents budget shortfalls after moving in.

Frequently Asked Questions

What credit score do I need for the best first time buyer mortgage rates? For optimal conventional loan rates, aim for a FICO score of 740 or higher. For FHA loans, you may qualify with a score as low as 580 (with a 3.5% down payment), but scores above 680 will generally secure better terms even within FHA guidelines.

How much should I save for a down payment as a first-time buyer? While 20% is ideal to avoid PMI, many programs cater to lower savings. FHA requires 3.5%, conventional loans can go as low as 3%, and VA/USDA loans require 0%. Remember to also budget for 2% to 5% of the home’s price in closing costs.

Should I wait for mortgage rates to drop before buying? Trying to time the market is extremely difficult. A better strategy is to buy when you are financially ready and can comfortably afford the payment at current rates. You can always refinance later if rates fall significantly.

What is the difference between being pre-qualified and pre-approved? A pre-qualification is a preliminary estimate based on unverified information you provide. A pre-approval is a much stronger commitment: the lender verifies your financial documents (income, assets, credit) and issues a conditional commitment for a specific loan amount. Sellers view pre-approvals as far more serious.

Can I get a mortgage with student loan debt? Yes, it is very common. Lenders will include your student loan payment in your DTI calculation. If you are on an income-driven repayment plan, lenders may use the documented payment amount, not the full balance, which can help your qualifying ratios.

The journey to securing a great first time buyer mortgage rate is a marathon of financial preparation, not a sprint. By understanding the factors within your control, diligently comparing loan offers, and looking beyond the advertised rate to the true cost of homeownership, you position yourself not just to get a key, but to build a stable and affordable financial future in your new home. Start the process early, gather your documents, and approach each step with informed confidence.

Take control of your homebuying journey. Visit Check Your Rate to get personalized rate insights and connect with a mortgage expert.