Understanding Refinance Closing Fees: A Comprehensive Breakdown

You’ve crunched the numbers, found a lower interest rate, and are ready to save hundreds on your monthly mortgage payment. Then you see the estimate for refinance closing fees, and the initial sticker shock can make you question the whole endeavor. These fees, often lumped under the umbrella of “closing costs,” are the necessary and often misunderstood price of securing a new loan. Unlike your original mortgage, where fees might have been rolled into a larger sum, refinancing forces a direct confrontation with these expenses. Understanding what you’re paying for, why it costs what it does, and how to strategically manage these fees is the key to ensuring your refinance truly delivers on its promise of long-term savings.

To confidently navigate your refinance closing fees and secure the best deal, compare personalized loan estimates at Estimate Your Fees.

What Exactly Are Refinance Closing Fees?

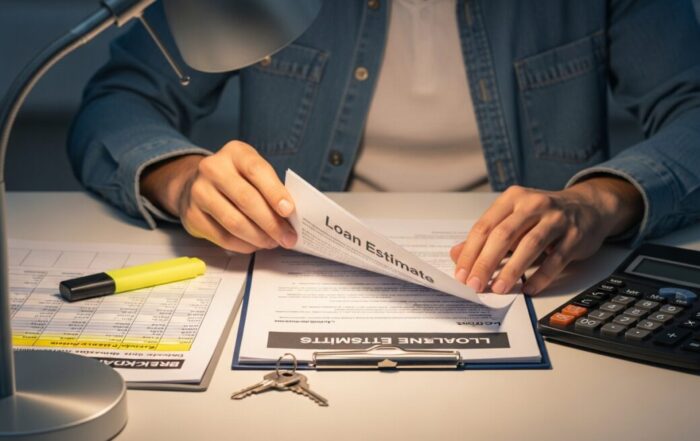

Refinance closing fees are the collection of charges and expenses you pay to finalize and secure your new mortgage loan, replacing your old one. They cover the administrative, legal, and third-party services required to process, underwrite, and record the new lien on your property. It’s a common misconception that these fees are just lender profit; in reality, a significant portion is paid to independent entities like appraisers, title companies, and government offices. The total typically ranges from 2% to 6% of your new loan amount, meaning on a $300,000 refinance, you could be looking at $6,000 to $18,000. This wide variance depends on your loan size, property location, lender, and the specific services required. The critical document that details every anticipated cost is the Closing Disclosure, which you receive at least three business days before closing, providing a final opportunity to review.

The Core Components of Your Closing Cost Breakdown

To navigate closing fees confidently, you must dissect the estimate into its core parts. These costs generally fall into three primary buckets: lender fees, third-party services, and prepaid items. Lender fees are charges levied directly by your mortgage company for originating and processing the loan. Third-party fees are for services the lender requires but are performed by independent companies. Prepaids are not true “fees” but are upfront payments for ongoing expenses like property taxes and homeowners insurance that will be held in your new escrow account.

Lender Origination and Processing Fees

This category includes the direct cost of doing business with your chosen lender. The most prominent fee here is often the origination charge, which can be a flat fee or a percentage of the loan (e.g., 0.5% to 1%). This compensates the lender for the work of creating the loan. You may also see separate line items for underwriting, processing, and document preparation. Some lenders bundle these into one “origination fee,” while others list them separately. It’s essential to ask for a clear explanation of each lender fee and to compare this section carefully between loan estimates, as these are costs where lenders have the most discretion and where you may find room for negotiation.

Essential Third-Party Services

These are non-negotiable costs paid to vendors. The appraisal fee, usually $500 to $800, pays for a licensed professional to determine your home’s current market value, a critical step for the lender. Title insurance and related services are another major component. This includes a title search to ensure there are no unknown liens or ownership disputes, and title insurance policies that protect both you and the lender from future claims. While you often cannot shop for the appraisal company (the lender orders it), you frequently have the right to shop for the title and settlement service provider, which can lead to significant savings. Other common third-party fees include credit report charges, flood certification, and courier fees.

Strategies to Manage and Reduce Your Closing Costs

Facing a five-figure closing cost estimate doesn’t mean you’re powerless. Several strategic approaches can make these fees more manageable and improve the overall financial benefit of your refinance. The first and most powerful step is simply to shop around. Obtain detailed Loan Estimates from at least three different lenders and compare them side-by-side, focusing on both the interest rate and the closing costs in Section A (Origination Charges) and Section B (Services You Cannot Shop For). Lenders have different fee structures, and a slightly higher rate from a lender with dramatically lower fees might result in a better deal over time.

One of the most common strategies is to opt for a “no-closing-cost” refinance. It’s crucial to understand this is a misnomer; the costs aren’t waived. Instead, the lender either increases your interest rate to cover them or rolls the fees into your loan balance. This is an excellent option if you plan to sell or refinance again in the near future, as you avoid upfront out-of-pocket expense. Conversely, if you plan to stay in the home for the long term, paying the fees upfront in exchange for the lowest possible rate usually yields greater lifetime savings. Another tactic is to negotiate with your lender, especially on their own origination fees. If you have a competing Loan Estimate, you may have leverage to ask them to match or beat an offer.

Analyzing the Break-Even Point: When Do You Truly Start Saving?

The fundamental math behind any refinance decision hinges on the break-even analysis. This calculation tells you how long it will take for the monthly savings from your new, lower payment to equal the amount you paid in upfront closing fees. To calculate it, simply divide your total closing costs by your monthly savings. For example, if your closing costs are $6,000 and your new payment is $200 less per month, your break-even point is 30 months ($6,000 / $200 = 30). If you plan to stay in the home longer than 30 months, the refinance is financially beneficial. If you might sell before then, it likely is not.

To confidently navigate your refinance closing fees and secure the best deal, compare personalized loan estimates at Estimate Your Fees.

This analysis must be the cornerstone of your decision. A refinance with ultra-low closing fees but a minimal rate reduction might have a short break-even period but offer little long-term value. Conversely, a refinance with high fees that secures a dramatically lower rate could have a longer break-even period but massive savings over 10 or 15 years. You must weigh this timeline against your life plans. Furthermore, consider the impact on your loan term. If you’re 10 years into a 30-year mortgage and refinance into a new 30-year loan, you’re resetting the clock and may pay more interest over the full life of the loan, even with a lower rate. A detailed comparison of all loan costs over time is essential, a topic we explore further in our guide to home loan closing fees and costs.

Common Pitfalls and Questions to Ask Your Lender

Many homeowners enter the refinance process with optimism but without asking the precise questions that prevent surprises. A major pitfall is focusing solely on the interest rate while ignoring the Annual Percentage Rate (APR). The APR incorporates the interest rate plus certain closing costs, providing a more accurate picture of the loan’s true annual cost. Always compare APRs when evaluating lenders. Another mistake is not accounting for the reset of your escrow account. When you refinance, your old escrow account is closed, and any balance is refunded to you, but a new escrow account is funded with several months of prepaid taxes and insurance, which is a significant upfront cash requirement.

To avoid these pitfalls, come to the table prepared with specific questions. Ask your lender for a detailed, line-item explanation of every charge on the Loan Estimate. Inquire which fees are negotiable and which are set by third parties. Crucially, ask: “What is the par rate, and what is the cost in points or fees to buy down to a lower rate?” This reveals the direct relationship between rate and cost. Finally, clearly understand the timeline for your old escrow refund and how it will interact with the need to fund the new one, as this affects your immediate cash flow.

Frequently Asked Questions About Refinance Closing Fees

Can I roll my refinance closing fees into the new loan? Yes, in most cases, you can finance the closing costs by adding them to your loan balance, provided you have sufficient equity. This increases your total borrowed amount and slightly raises your monthly payment compared to paying fees upfront, but it requires no cash at closing.

Are refinance closing fees tax-deductible? The tax treatment of mortgage points and fees has changed. For a refinance, points paid (a type of prepaid interest) are generally deductible, but they must be amortized over the life of the loan. Other fees like appraisal or title insurance are not deductible. Always consult a tax professional for your specific situation, as rules can be complex.

What is the difference between ‘discount points’ and ‘origination points’? Discount points are fees you pay upfront to “buy down” your interest rate, lowering your monthly payment. Each point typically costs 1% of the loan amount and lowers the rate by about 0.25%. Origination points are fees charged by the lender to cover the cost of making the loan; they do not lower your rate.

Do I have to pay closing fees again if I just refinanced a year ago? Yes. Each refinance is a new loan transaction, requiring a new appraisal, title work, underwriting, and all associated fees. The break-even analysis becomes even more critical for successive refinances.

What happens if my home appraises for less than expected? A low appraisal can disrupt a refinance. It may mean you qualify for a smaller loan amount than planned, or you may not meet the lender’s required loan-to-value ratio. You might need to bring more cash to closing to cover the gap, or the transaction could be canceled.

Refinance closing fees are not merely an obstacle; they are an integral part of the transaction’s economics. By demystifying each component, strategically evaluating your options for paying them, and rigorously calculating your personal break-even point, you transform these costs from a source of confusion into a lever for informed financial decision-making. The goal is not necessarily to find the absolute lowest fees, but to find the optimal combination of rate, cost, and loan terms that aligns with your financial roadmap and homeownership timeline. With this knowledge, you can approach the closing table not with apprehension, but with confidence, knowing precisely what you are paying for and why it makes long-term sense for your financial future.

To confidently navigate your refinance closing fees and secure the best deal, compare personalized loan estimates at Estimate Your Fees.